Micropayments for Peer-to-peer currencies

@inproceedings{PS15b,

author = {Rafael Pass and abhi shelat},

title = {Micropayments for peer-to-peer currencies},

booktitle = {CCS'2015},

year = {2015},

}All electronic financial transactions in the US, even those enabled by Bitcoin, have relatively high transaction costs. As a result, it becomes infeasible to run \emph{micropayments}, i.e. payments that are on the order of pennies or even fractions of a penny.

In order to circumvent the cost of recording all transactions, Wheeler (1996) and Rivest (1997) suggested the notion of a probabilistic payment, that is, one implements payments that have \emph{expected} value on the order of micro pennies by running an appropriately biased lottery for a larger payment. While there have been quite a few proposed solutions to such lottery-based micropayment schemes, all these solutions rely on a trusted third party to coordinate the transactions; furthermore, to implement these systems in today’s economy would require a a global change to how either banks or electronic payment companies (e.g., Visa and Mastercard) handle transactions.

We put forth a new lottery-based micropayment scheme for Bitcoins, and more generally any ledger-based transaction system, that can be used today without any change to the current infrastructure.

Graphs from the paper

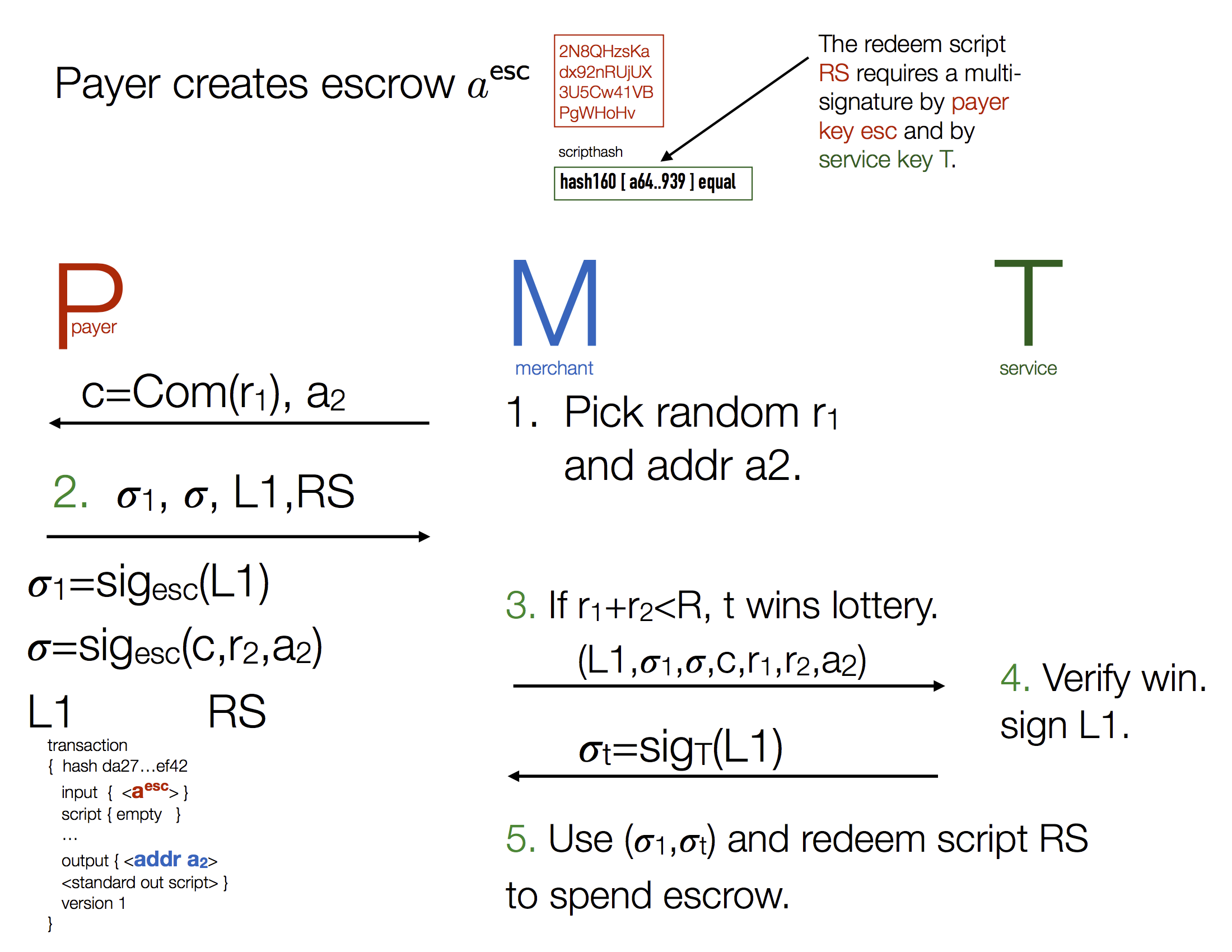

A diagram of the messages involved in the 2nd version of our protocol.

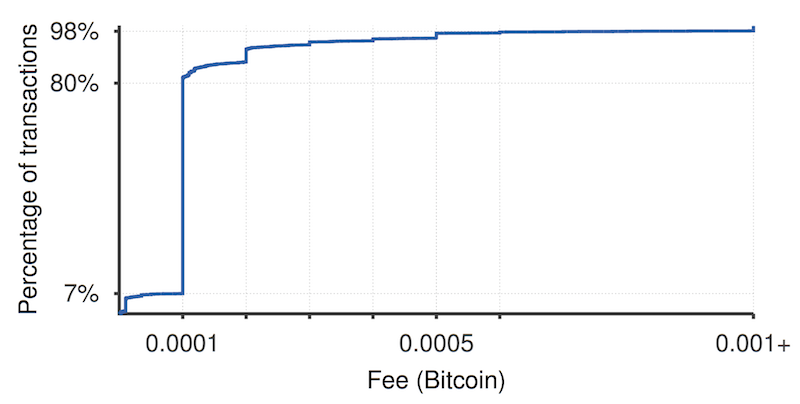

92% of the transactions have a fee between 0.0001 and 0.0005 bitcoin

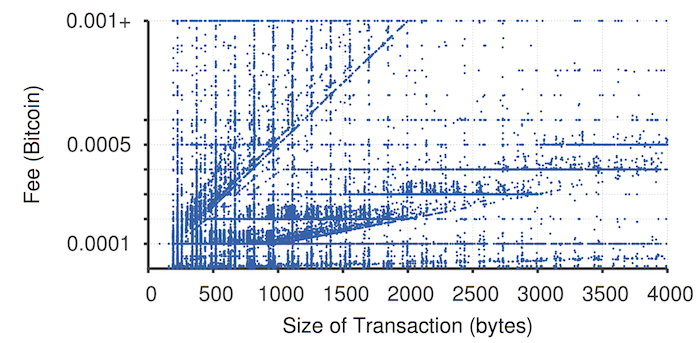

The transaction fee is purportedly related to the size of a transaction and the age of the ``from" account.